Interest Coverage Ratioīusiness credit cards are useful for maintaining the corporate veil, building business credit, and ensuring your business has the power to cover necessary business expenditures. In other words, focusing on improving NWC will help improve a company’s overall financial health. When all else is equal, a company would prefer to have more assets than liabilities, so improvements to NWC usually indicate that the company is moving in a financially stable, liquid direction.

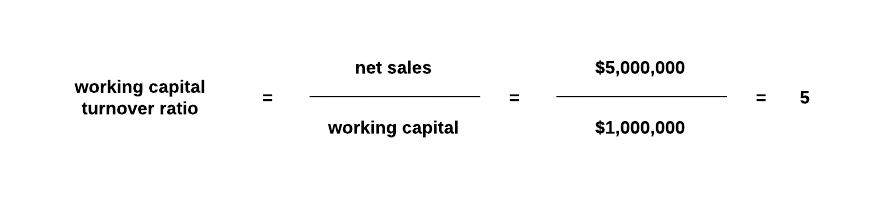

Net working capital uses a simple formula that makes it easy to determine whether a company is capable of meeting it’s short-term financial obligations. NWC is important because it is necessary in order for businesses to remain solvent. Trade working capital is the difference between current assets and current liabilities directly associated with everyday business operations. On the other hand, a ratio above 1 shows outsiders that the company can pay all of its current liabilities and still have current assets left over or positive working working capital ratio formula capital. This provides an honest picture of the company’s short-term financial health. A healthy business will have ample capacity to pay off its current liabilities with current assets. If the business does not have enough cash to pay the bills as they become due, it will have to borrow more money, which will in turn increase its short-term obligations. Negative working capital, on the other hand, means that the business doesn’t have enough liquid assets to meet it current or short-term obligations. If this company’s liabilities exceeded their assets, the working capital would be negative and therefore lack short-term liquidity for now. Working Capital: The Quick Ratio And Current Ratio Too much inventory in stock attracts storage and maintenance cost, which in turn reduces the company’s profit. A low ratio could mean the firm’s operation is efficient in terms of converting its stock inventories into cash hence can generate extra revenue with the available working capital. You can use the inventory to working capital ratio calculator below to quickly calculate the exact portion of the business’s working capital that is tied up in its inventories by entering the required numbers. Simply put, inventory to working capital ratio measures the percentage of the company’s net working capital that is financed by its inventory. In other words, inventory to working capital ratio measures how well a company can generate additional cash using its net working capital at its current inventory level. The inventory to working capital ratio allows investors to calculate the exact portion of the business’s working capital that is tied up in its inventories. Also, some companies can have a very high ratio due to financial limitations. This ratio needs to be used in conjunction with other ratios, especially inventory turnover, to make an informed decision. The Working Capital Turnover Ratio is calculated by dividing the company’s net annual sales by its average working capital. The basic calculation of working capital is based on the entity’s gross current assets. To reflect current market conditions and use the lower of cost and market method, a company marks the inventory down, resulting in a loss of value in working capital.

When that happens, the market for the inventory has priced it lower than the inventory’s initial purchase value as recorded in the accounting books. The more working capital a company has, the less it’s likely to have to take on debt to fund the growth of its business. A higher ratio also means the company can easily fund its day-to-day operations.

0 kommentar(er)

0 kommentar(er)